Nonmanufacturing Overhead Explanation Explanation

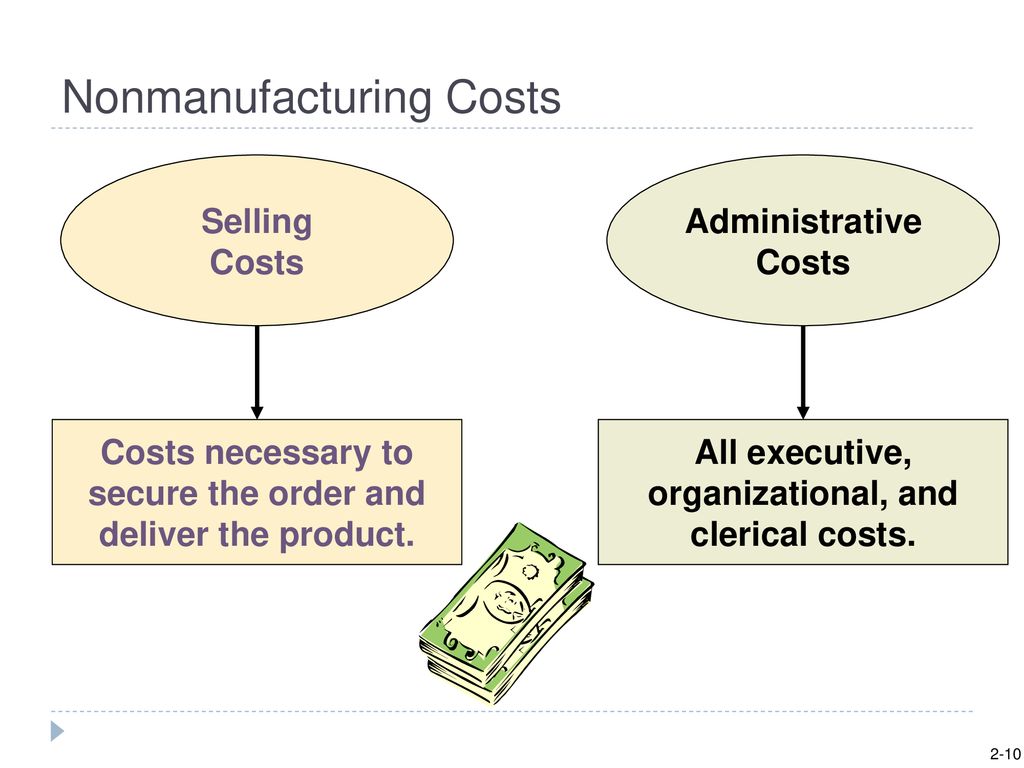

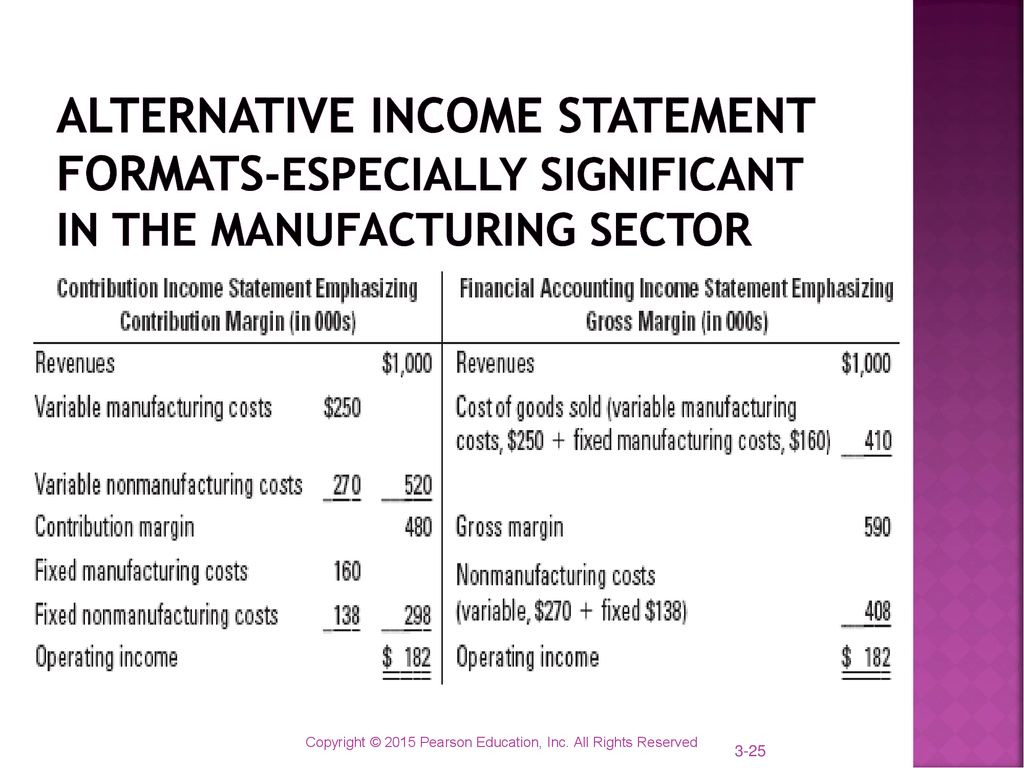

Distinguishing between the two categories is critical because the category determines where a cost will appear in the financial statements. As we indicated earlier, nonmanufacturing costs are also called period costs; that is because they are expensed on the income statement in the time period in which they are incurred. Factory overhead – also called manufacturing overhead, refers to all costs other than direct materials and direct labor spent in the production of finished goods. Even though nonmanufacturing overhead costs are not product costs according to GAAP, these expenses (along with product costs and profit) must be covered by the selling prices of a company’s products. In other words, selling prices must be large enough to cover SG&A expenses, interest expense, manufacturing overhead, direct labor, direct materials, and profit. Nonmanufacturing costs are necessary to carry on general business operations but are not part of the physical manufacturing process.

Nonmanufacturing overhead costs definition

- Overhead is part of making the good or providing the service, whereas selling costs result from sales activity and administrative costs result from running the business.

- Here’s an interesting case study on how manufacturing cost analysis helped a steel manufacturing company save costs.

- The key takeaway of this case study is that understanding the fluctuations in manufacturing costs can empower companies to make informed and timely choices between outsourcing and in-house production.

- Manufacturing and non-manufacturing costs together form total costs for a manufacturing entity.

- In general, overhead refers to all costs of making the product or providing the service except those classified as direct materials or direct labor.

We use the term nonmanufacturing overhead costs or nonmanufacturing costs to mean the Selling, General & Administrative (SG&A) expenses and Interest Expense. Under generally accepted accounting principles (GAAP), these expenses are not product costs. (Product costs only include direct material, direct labor, and manufacturing overhead.) Nonmanufacturing costs are reported on a company’s income statement as expenses in the accounting period in which they are incurred. In general, overhead refers to all costs of making the product or providing the service except those classified as direct materials or direct labor.

Step #3: Add up the other direct expenses

The company engaged a consulting firm to help them find out what factors were driving up manufacturing costs. By looking at the historic data on employee timesheets and purchasing costs, the firm was able to understand the areas that were increasing the total manufacturing costs. Direct labor costs include the wages and benefits paid to employees directly involved in the production process of goods or products.

Manufacturing Overhead (Explanation Part

Rather, nonmanufacturing expenses are reported separately (as SG&A and interest expense) on the income statement for the accounting period in which they are incurred. The wood used to build tables and the hardware used to attach table legs would be considered direct materials. Small, inexpensive items like glue, nails, and masking tape are typically not included in direct materials because the cost of tracing these items to the product outweighs the benefit of having accurate cost data. These minor types of materials, often called supplies or indirect materials, are included in manufacturing overhead, which we define later. That part of a manufacturer’s inventory that is in the production process and has not yet been completed and transferred to the finished goods inventory. This account contains the cost of the direct material, direct labor, and factory overhead placed into the products on the factory floor.

Indirect labor consists of the cost of labor that cannot, or will not for practical reasons, be traced to the products being manufactured. Costs that are not related to the production of goods are called nonmanufacturing costs; they are also referred to as period costs. These costs have two components—selling costs and general is interest on a home equity line of credit and administrative costs—which are described next. As their names indicate, direct material and direct labor costs are directly traceable to the products being manufactured. Manufacturing overhead, however, consists of indirect factory-related costs and as such must be divided up and allocated to each unit produced.

Manufacturing costs, for the most part, are sensitive to changes in production volume. A lower per-item fixed cost motivates many businesses to continue expanding production up to its total capacity. This allows the business to achieve a higher profit margin after considering all variable costs.

With all this valuable information under your belt, you can better track manufacturing costs as they pertain to your workforce. Here are some frequently asked questions (FAQs) and answers that address key concepts related to manufacturing costs. With a breakup of all the costs of manufacturing, management can decide whether it is more profitable to purchase certain parts or materials from a vendor or manufacture them in-house. As you can see, by collecting cost data and calculating it accurately, businesses can optimize cost management and set the right price for their products to gain a competitive advantage. Here’s an interesting case study on how manufacturing cost analysis helped a steel manufacturing company save costs. For instance, if some raw materials are driving up costs, manufacturers can negotiate with other suppliers who may be willing to supply these materials at a lower cost.

The opportunity to achieve a lower per-item fixed cost motivates many businesses to continue expanding production up to total capacity. Direct materials are raw materials that become an integral part of the finished goods. When inventory items are acquired or produced at varying costs, the company will need to make an assumption on how to flow the changing costs. This article looks at meaning of and differences between two main cost categories for a manufacturing entity – manufacturing cost and non-manufacturing cost. Costs that remain constant regardless of the level of production or sales, such as rent and salaries. Manufacturing cost calculation gives an accurate view of the costs allowing companies to eliminate irrelevant costs and optimize resource utilization to boost profitability.