Manufacturing and Non-manufacturing Costs: Online Accounting Tutorial & Questions

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Therefore, always of the stock consult with accounting and tax professionals for assistance with your specific circumstances. This account is a non-operating or “other” expense for the cost of borrowed money or other credit.

What are nonmanufacturing overhead costs?

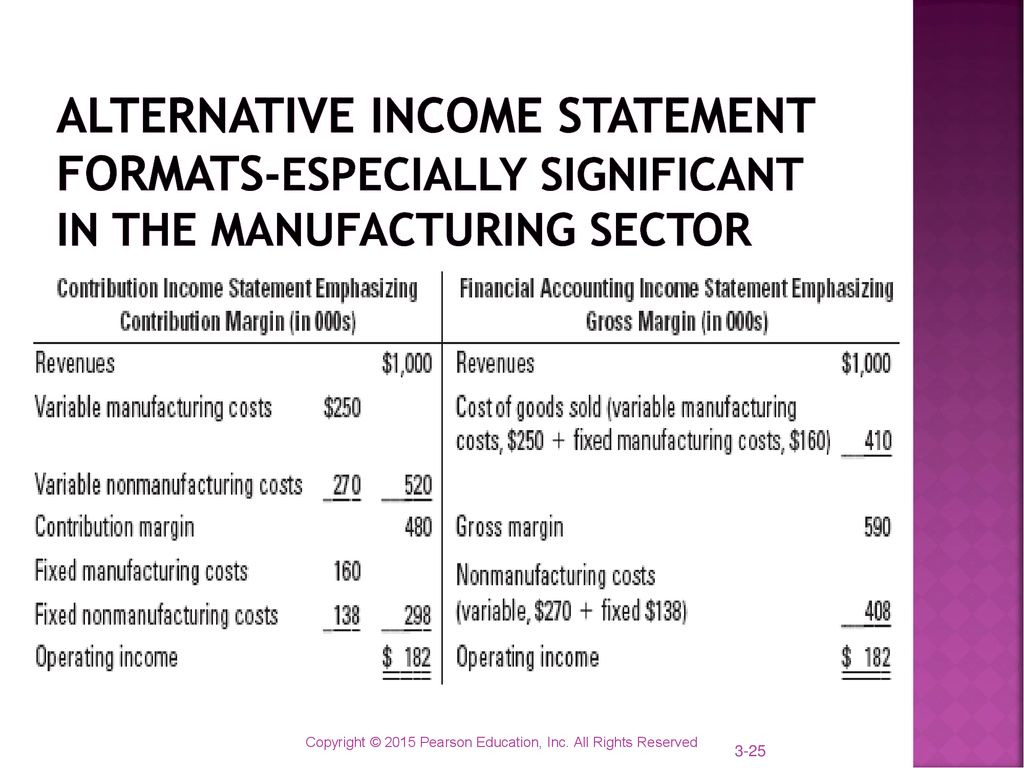

On the other hand, a product with a low gross profit may actually be very profitable, if it uses only a minimal amount of administrative and selling expense. As mentioned above, nonmanufacturing costs cannot be included in inventory or the cost of goods sold; rather, nonmanufacturing costs are reported as SG&A expenses and Interest Expense in the accounting period in which they occur. To help clarify which costs are included in these three categories, let’s look at a furniture company that specializes in building custom wood tables called Custom Furniture Company. Each table is unique and built to customer specifications for use in homes (coffee tables and dining room tables) and offices (boardroom and meeting room tables). The sales price of each table varies significantly, from $1,000 to more than $30,000. Figure 2.3.1 shows examples of production activities at Custom Furniture Company for each of the three categories.

Part of cost of goods sold

A manufacturing company initially purchased individual components from different vendors and assembled them in-house. As the company decided to assemble the components themselves, they found that the costs of managing the assembly line and the transportation were increasing significantly. According to the book Manufacturing Cost Estimating, the benefits of calculating the costs of manufacturing range from guiding investment decisions to cost control. Cost is a financial measure of the resources used or given up to achieve a stated purpose. Product costs are the costs of making a product, such as an automobile; the cost of making and serving a meal in a restaurant; or the cost of teaching a class in a university.

How Liam Passed His CPA Exams by Tweaking His Study Process

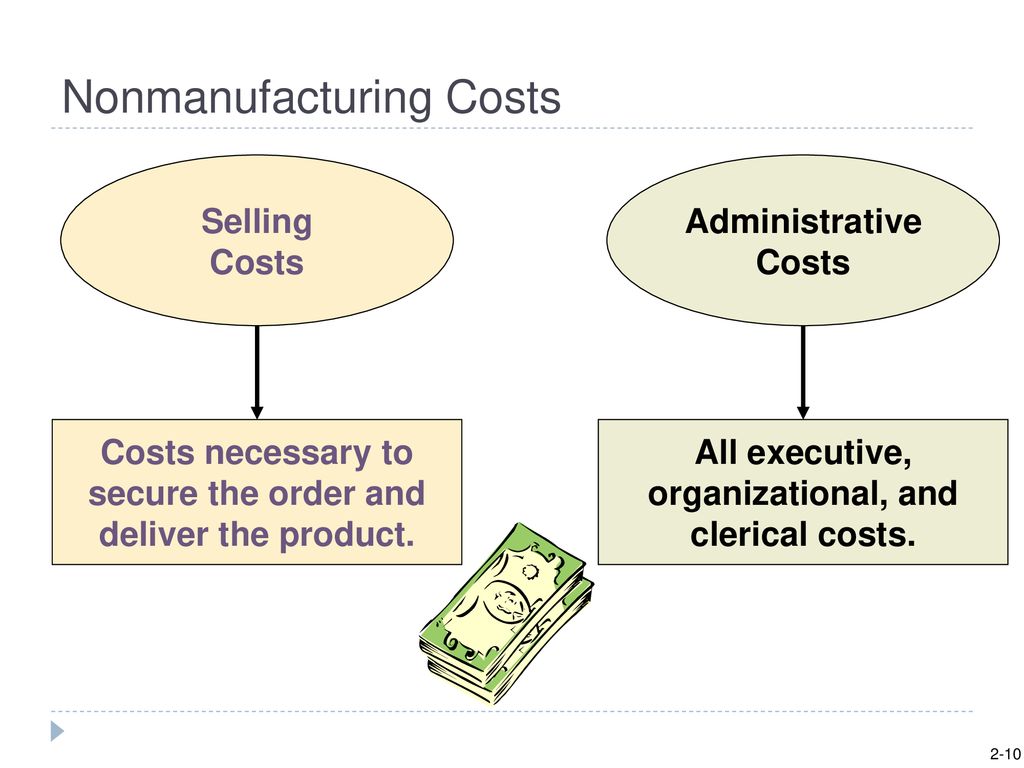

All nonmanufacturing costs are not related to production and are classified as either selling costs or general and administrative costs. These costs are reported on a company’s income statement below the cost of goods sold, and are usually charged to expense as incurred. Since nonmanufacturing overhead costs are treated as period costs, they are not allocated to goods produced, as would be the case with factory overhead costs.

AccountingTools

Though most of these costs are self-evident, indirect material costs are unique because these costs are not essential to the physical production of the product. All manufacturing costs that are easily traceable to a product are classified as either direct materials or direct labor. All other manufacturing costs are classified as manufacturing overhead.

Some Examples of Non-manufacturing Costs

The consulting firm was also able to re-negotiate the manufacturing company’s contracts with poor-performing suppliers. As employees use Clockify to clock in and out, employers gain insights into the total number of hours each employee worked on each production line. This account balance or this calculated amount will be matched with the sales amount on the income statement. It is likely that you will have to estimate the cost of these activities. Next, you will need to allocate the cost of the activities to the individual products. Estimates and allocations based on logical assumptions are better than precise amounts based on faulty assumptions.

(Some service organizations have direct labor but not direct materials.) In manufacturing companies, manufacturing overhead includes all manufacturing costs except those accounted for as direct materials and direct labor. Manufacturing overhead costs are manufacturing costs that must be incurred but that cannot or will not be traced directly to specific units produced. In addition to indirect materials and indirect labor, manufacturing overhead includes depreciation and maintenance on machines and factory utility costs. Look at the following for more examples of manufacturing overhead costs.

Manufacturing and non-manufacturing costs together form total costs for a manufacturing entity. They are impacted by different factors and thus their appropriate categorization is important. Manufacturing cost overruns indicate production inefficiency whereas non-manufacturing cost overruns indicate inefficiency in other areas of operations.

- Recall from other tutorials that variable costs change in proportion to production.

- These fringe benefit costs can significantly increase the direct labor hourly wage rate.

- While these costs are necessary for the overall functioning of the business, they do not directly contribute to the production of goods or services.

- That’s why you need a reliable partner to buddy up with and slash your costs.

- For instance, if the manufacturing costs are too high, these costs can create a dent in the company’s profit.

Let’s go through all the steps for calculating total manufacturing costs. Now that you are familiar with the components that constitute manufacturing costs, let’s move on to the process of calculating these expenses. Whether you’re just starting your own manufacturing business or are looking to venture into the field of cost accounting, understanding manufacturing costs and knowing how to accurately calculate them is crucial for success. In this example, the total production costs are $900 per month in fixed expenses plus $10 in variable expenses for each widget produced.

Material costs are the costs of raw materials used in manufacturing the product. By calculating manufacturing costs, manufacturers can better understand the elements that are driving up costs while identifying the most economical way to manufacture a product. Now, add the value of existing inventory to the cost of purchasing new inventory to calculate the cost of direct materials. Start by making a list of all the direct materials that are used to make the specific product and obtain the cost information for the direct materials you have identified. To calculate the cost of direct materials you need to know the cost of inventory.