LIFO vs FIFO Learn About the Two Inventory Valuation Methods

LIFO, on the other hand, offers a strategic tax advantage by aligning the cost of goods sold with current market prices. This results in lower taxable income during periods of rising prices, effectively reducing the company’s tax liability. The tax savings can be reinvested into the business, fostering innovation, expansion, or debt reduction. However, it’s important to note that LIFO is not permitted under International Financial Reporting Standards (IFRS), limiting its use to companies that primarily report under U.S. Under FIFO, the ending inventory is composed of the most recently purchased items, which are typically higher in cost during inflationary times.

Last In, First Out (LIFO): The Inventory Cost Method Explained

Your inventory valuation technique depends on the market conditions, and your financial goals for your organization. Here are a few scenarios which can help you to pin down the best inventory valuation technique for your business. Many businesses find this requirement alone negates any benefits of LIFO valuation. By contrast, the inventory purchased in more recent periods is cheaper than those purchased earlier (i.e. older inventory costs are more expensive).

Why would businesses use last in, first out (LIFO)?

In this case, the store sells 100 of the $50 units and 20 of the $54 units, and the cost of goods sold totals $6,080. Let’s assume that a sporting goods store begins the month of April with 50 baseball gloves in inventory and purchases an additional 200 gloves. Goods available for sale totals 250 gloves, and the gloves are either sold (added to cost of goods sold) or remain in ending inventory. If the retailer sells 120 gloves in April, ending inventory is (250 goods available for sale – 120 cost of goods sold), or 130 gloves. The company made inventory purchases each month for Q1 for a total of 3,000 units.

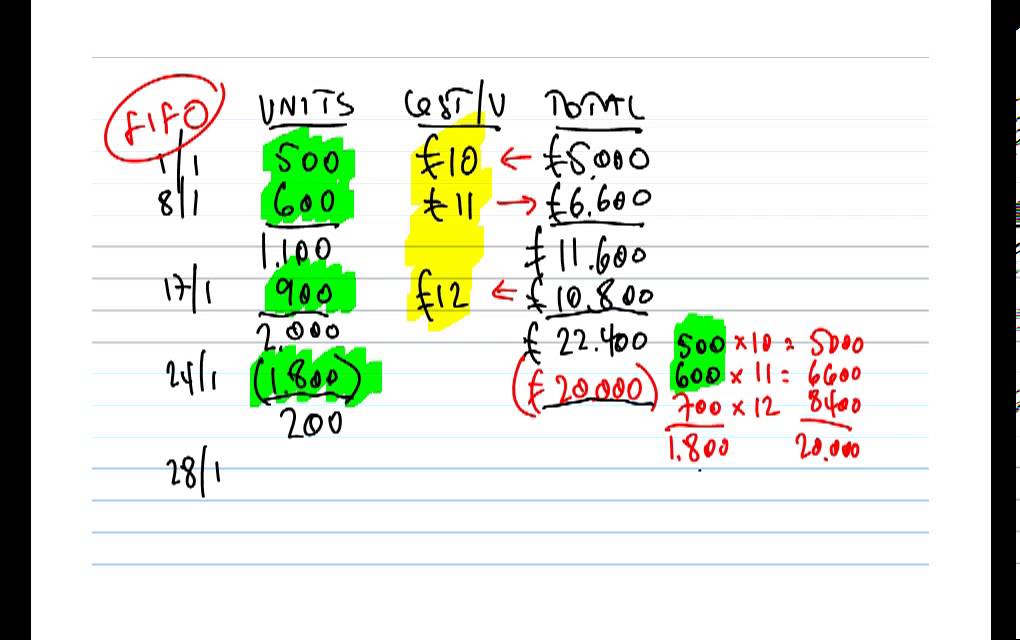

What Is the FIFO Method?

CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. Consider a dealership that pays $20,000 for a 2015 model car during spring and $23,000 for the same during fall. In December, the dealership sells one of these automobiles for $26,000.

You conduct a physical inventory and determine you have sold 120 spools of wire during this same period. While the weighted average method is a generally accepted accounting principle, this system doesn’t have the sophistication needed to track FIFO and LIFO inventories. If a company uses a LIFO valuation when it files taxes, it must also use LIFO when it reports financial results to its shareholders, which lowers its net income. The percentage difference in the inventory cost per unit – a 100% increase (i.e. 2.0x) – shows how the retailer’s more recent spending on inventory purchases has increased compared to prior purchases.

- Before diving into the inventory valuation methods, you first need to review the inventory formula.

- The sum of $6,480 cost of goods sold and $6,620 ending inventory is $13,100, the total inventory cost.

- As a result, LIFO isn’t practical for many companies that sell perishable goods and doesn’t accurately reflect the logical production process of using the oldest inventory first.

- Under FIFO, older (and therefore usually cheaper) goods are sold first, leading to a lower average cost of goods sold.

- If inflation were nonexistent, then all three of the inventory valuation methods would produce the same exact results.

Companies within the U.S. have greater flexibility on the method they may choose and can opt for either LIFO or FIFO. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, what is the purpose of an invoice tax preparation, and credit. Under LIFO, Company A sells the $240 vacuums first, followed by the $220 vacuums then the $200 vacuums. With LIFO, the purchase price begins with the most recently purchased goods and works backward. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation.

By using the most recent costs to calculate COGS, LIFO can provide a more accurate reflection of current market conditions. However, this often results in higher COGS and lower profits during inflationary periods, as the latest, more expensive inventory is accounted for first. When all 250 units are sold, the entire inventory cost ($13,100) is posted to the cost of goods sold. Let’s assume that Sterling sells all of the units at $80 per unit, for a total of $20,000. The profit (taxable income) is $6,900, regardless of when inventory items are considered to be sold during a particular month.

So, the cost of the widgets sold will be recorded as $900, or five at $100 and two at $200. Therefore, considering the older, more expensive inventory was recognized, net income is lower under FIFO for the given period. LIFO, or Last In, First Out, is an inventory value method that assumes that the goods bought most recently are the first to be sold. When calculating inventory and Cost of Goods Sold using LIFO, you use the price of the newest goods in your calculations. In addition, consider a technology manufacturing company that shelves units that may not operate as efficiently with age. No, the LIFO inventory method is not permitted under International Financial Reporting Standards (IFRS).

However, this results in higher tax liabilities and potentially higher future write-offs if that inventory becomes obsolete. In general, for companies trying to better match their sales with the actual movement of product, FIFO might be a better way to depict the movement of inventory. The most significant difference between FIFO and LIFO is its impact on reported income and profits. For FIFO, higher gross income and profits may look more appealing to investors, but it will also result in a higher tax bill. Under LIFO, lower reported income makes the business look less successful on paper, but it also has a lower tax liability.

It allows them to record lower taxable income at times when higher prices are putting stress on their operations. The oldest, less expensive items remain in the ending inventory account. The store’s ending inventory balance is 30 of the $54 units plus 100 of the $50 units, for a total of $6,620.