Equivalent Units FIFO Method Example

The limitation of equivalent units computation is that it does not take into account the number of units completed in any specific unit. For example, let’s assume that a company manufactured 2000 motorcycles for this year and 30% of motorcycles were lost due to defects. If these defects are non recurring then such units should be excluded from equivalent production. Essentially, the concept ofequivalentunits involves expressing a given number ofpartially completed units as a smaller number of fully completedunits. We do this because it is easier to account for whole unitsthen parts of a unit.

Evaluation of Equivalent Units of Production

We already covered how the weighted average and FIFO methods define the denominators differently. For the weighted average method, you add beginning balances to current period costs. If this seems daunting, just remember that the percent completion for transferred-in costs is always 100%.

Get in Touch With a Financial Advisor

The implicit assumption is that all units in the group are roughly at the average same level of completion (process costing firms are very unlikely to find it useful to get more specific than that). Finally, the equivalent units of production calculated via the previous three steps should be aggregated to ascertain the total output in terms of equivalent units or equivalent production. These costs are then used to calculate the equivalent units and total production costs in a four-step process. I explained, above, FIFO’s Step #3 using what’s called the subtractive method. I told you to subtract the beginning WIP equivalent units from the total units completed so we could apply the rates to the equivalent units completed using this period’s work. Even though the firm needs an aggregate number to get overall ending WIP value, the firm will want to keep data on how much of that $20,493.81 is due to conversion costs, direct materials, and transferred-in costs.

- Transferred-in costs are incurred in a different department during a process completed by that department.

- Again, the only difference between the two methods is that stinking beginning WIP.

- The units in beginning WIP are effectively treated as if they had no work done on them at all in the prior period, and they are lumped in with all the other units completed this period.

- Prepare a cost of production report for the packaging department of Company ABC for the month of December 2013 under FIFO method of process costing.

- Together, equivalent units and the chosen method (either FIFO or Weighted-Average) help companies accurately calculate production costs.

What is your current financial priority?

Obviously the units started and completed during the period are 100% complete and the equivalent units are the same as the physical units. The beginning WIP units are already partially complete at the start of the period and are further completed during the period and need to be converted to equivalent units. Likewise, the ending work in process units are only partially complete at the end of the period and again, need to be converted to equivalent units. Add that $860 to whatever we figured was the conversion cost of Units Started and Completed and we have the total conversion costs of units completed and transferred out.

Weighted Average

One thing to keep in mind when using the weighted average method, we don’t need to compute the equivalent units for the ones transferred out. Those are considered 100% complete for the work done in that department, otherwise they wouldn’t be moving forward to the next process. Equivalent units (EU) is a way to measure partially completed products as if they were fully completed. The reason we do it is because it helps to calculate the costs of products that are not yet finished at month-end or year-end. Without this, we can’t assign costs to products in different stages of completion, so we won’t know the true costs at period end.

Equivalent Units – FIFO Method

Instead the weighted average method completely detaches beginning WIP costs from partially-complete beginning WIP units. Beginning WIP units get lumped in with all “Completed Units” as if they had no work at all done last period. This leads to process costing, which tries to allocate actual overhead costs equally across homogeneous individual product units. Equivalent units FIFO method is used by a manufacturer to express partially completed units of product in terms of finished units.

A similar process is used to account for the costs completed and transferred. Reconciling the number of units and the costs is part of the process costing system. The reconciliation involves the total of beginning inventory and units started into production.

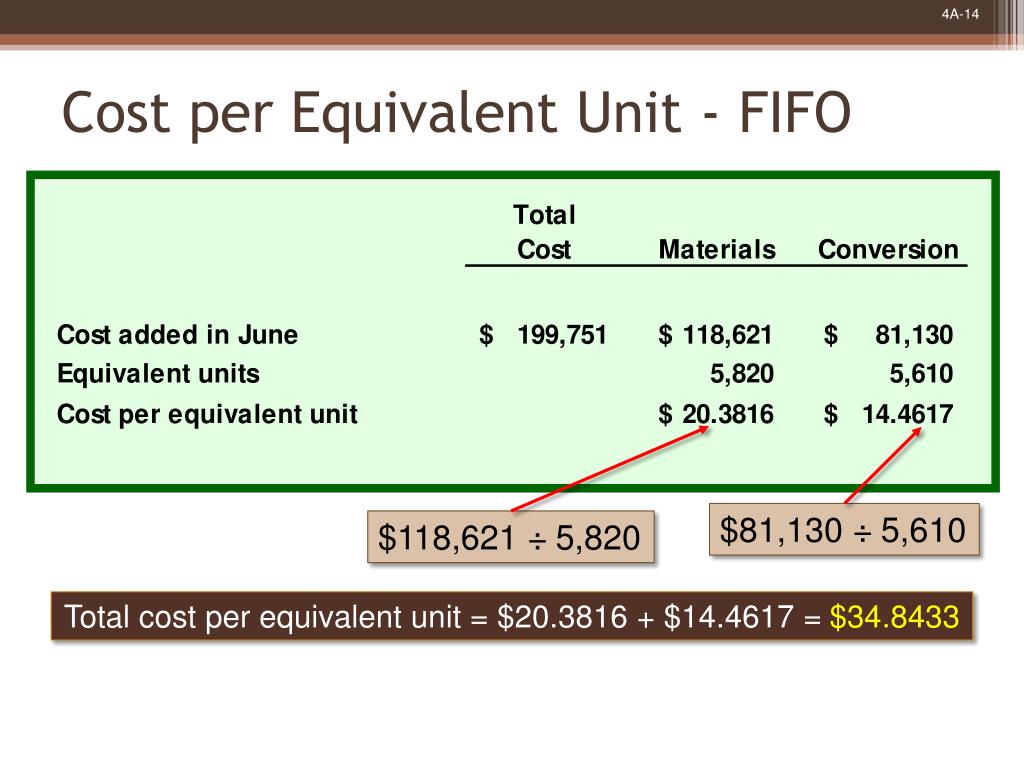

Once the equivalent units for materials and conversion are known, the cost per equivalent unit is computed in a similar manner as the units accounted for. The costs for material and conversion need to reconcile with the total beginning inventory and the costs incurred for the department during that month. The equivalent unit calculations are carried forward into the “cost per equivalent unit” schedule. This shows how the combined costs from beginning work in process (assumed at $2,122,500) and current period production (assumed at $7,365,000) are divided by the equivalent units. The result is the weighted-average cost per equivalent unit for each factor of production. The individual cost factors can be combined to identify conversion cost and overall cost per equivalent unit.

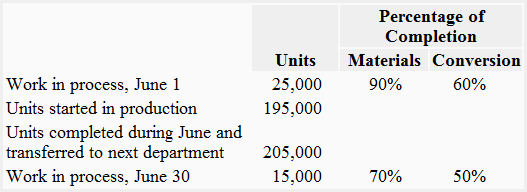

Beginning work in process is fully complete for materials (or 100% complete) and 60% complete for conversion so to complete these units we will need NO (or 0%) materials and 40% of conversion (100% – 60%). Units started and completed are always 100% complete what is certified payroll 2021 requirements and faq for materials, labor and overhead! Ending work in process is 1/3 complete for conversion costs, but what about materials? In addition to the equivalent units, it is necessary to track the units completed as well as the units remaining in ending inventory.